Your future, planned with confidence.

Westcotts Chartered Financial Planners deliver clear, independent advice for every scenario.

Whether you’re building wealth, planning for retirement, or protecting your family, we help you make informed decisions with confidence.

We provide completely independent financial advice. We have no ties to any providers of financial products or investment services. Our fees are straightforward and transparent. All our financial planners are employed by us and our fees are structured to avoid any conflict of interest in the advice we give.

As your priorities in life change your financial plans should adapt around you. Your financial health and security can depend on choosing the right financial planner for your needs.

Our Chartered title is the gold standard of excellence among financial planning firms. With increasing complexity in the financial world and constant scrutiny by the media, genuine professionalism has never been in such high demand. As Chartered Financial Planners you can be assured that the advice, service and ongoing support that we provide is of the highest quality.

Chartered Financial Planners Advice You Can Trust

How can we help you

Business Resilience & Protection Service

Work Place Pensions

Care Fees Advice

Equity Release

Estate Planning and Inheritance Tax Mitigation

Pensions Schemes

Wealth Management

Retirement Planning

Services for Business Owners

Services for Charities

Services for Trustees

The Financial Planning Process

Our process is designed to enable our clients to identify their financial and lifestyle objectives, and to achieve these objectives as far and as efficiently as possible.

Our aim is to be adaptable around your needs and our process is flexible enough to suit the different requirements of a range of private and business clients. Typically our advice process will include the following five steps:

- Initial Meeting

An initial meeting with you to discuss your requirements and to explore how we may help you. This comes with no obligation and is at our expense. - Research and Analysis

Should you choose to instruct us, we will carry out research and analysis to advise as to the suitability of your existing financial arrangements. We research financial solutions, products and services across the whole of the market. - Advice

We provide a written report confirming your personal financial objectives and detailing our specific recommendations. We offer a further meeting with you to present our recommendations, to discuss how these will help to achieve your goals and to answer your questions. - Implementation

Once we have agreed a course of action, we will implement our recommendations on your behalf; undertaking the necessary administration to establish any new financial products or services. - Ongoing Service

Our aim is to work with you, reviewing your financial arrangements periodically to ensure they continue to provide value for money and remain suitable for your needs.

Should you choose our ongoing financial planning services, we will agree a programme of reviews with you, aimed at the following:

- Measurement of ongoing performance and risk management.

- Keeping you up to date with changes in markets and financial product development.

- Keeping you up to date with changes in personal taxation.

- Reviewing your personal financial situation and objectives and adapting your plans to meet your needs.

As your priorities in life change, your financial health and security depend on adapting your financial plans around you. Choosing our ongoing service gives you the peace of mind that whatever life brings, we are on hand to help.

Specialist Advisers

Get in touch with one of our specialist advisers to see how we can help your business.

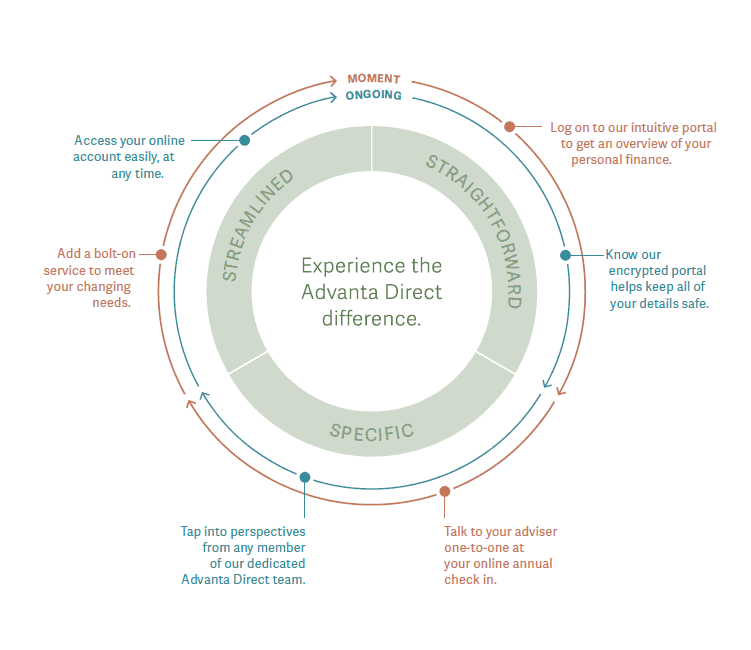

What you can expect with Advanta Direct.

Straightforward

Advanta Direct’s digital-first approach means easy access to our encrypted Personal Finance Portal, which helps keep your data safe and sound, and helps us offer a more sustainable approach to financial advice.

Specific

With Advanta Direct, you have a team committed to your specific needs, and access to a team of expert advisers online and by phone. All of these experts will know you and your unique circumstances. Plus, you’ll benefit from yearly check-ins with an adviser.

Streamlined

Meet your wealth specialists

Our clients benefit from a unique and professional service delivered by a team of experts, many of whom they know by name. That’s because we believe in personal, lasting relationships built on trust.